Employee Retention Credit: Unlock Your Refund with Bottomline Savings

In today’s competitive business landscape, employee retention has become a top priority for organizations seeking sustainable growth and success. Retaining talented employees not only fosters a positive work environment but also contributes to cost savings and increased productivity. In this comprehensive guide, we will delve into the Employee Retention Credit (ERC), an impactful government initiative that aims to support businesses in retaining their valuable workforce. Bottomline Savings helps your business navigate this process entirely and will help you claim this refundable tax credit which you don’t have to pay back. Click here to get on a call today to see if you qualify for free.

Understanding the Employee Retention Credit

The Employee Retention Credit, introduced as part of the Coronavirus Aid, Relief, and Economic Security (CARES) Act in 2020, is a valuable tax credit available to eligible employers who experienced significant disruptions due to the COVID-19 pandemic. It was later expanded and extended under subsequent legislation. The credit is designed to incentivize businesses to retain employees on their payroll, even during challenging times.

Eligibility Criteria

To qualify for the Employee Retention Credit, businesses must meet certain criteria. Initially, it applied to organizations that either experienced a full or partial suspension of operations due to a government order or demonstrated a significant decline in gross receipts. However, recent updates have expanded eligibility, making it accessible to a wider range of businesses. Click here to see if you qualify for free.

Benefit Calculation

The credit is calculated as a percentage of qualified wages paid to eligible employees during the designated period. Initially, the credit was set at 50% of qualified wages, up to $10,000 per employee, for qualified wages paid between March 13, 2020, and December 31, 2020. However, subsequent legislation increased the credit rate and extended the qualifying period.

Qualified Wages and Employee Count

To determine the amount of eligible wages, businesses need to understand what qualifies as qualified wages. Generally, qualified wages include compensation paid to employees, including certain health benefits, but there are limitations based on the number of employees. For employers with more than 100 full-time employees, only wages paid to employees who were not providing services due to the suspension or decline in business activity are considered qualified. For employers with 100 or fewer full-time employees, all wages qualify for the credit, regardless of whether employees were working or not. If you have 5 or more W-2 Employees you may qualify. See if you qualify for free here.

Claiming the Credit

To claim the Employee Retention Credit, eligible employers must file Form 941, the employer’s quarterly federal tax return, for the applicable quarters. Alternatively, employers can request an advance payment of the credit by submitting Form 7200. It’s crucial to maintain accurate records and documentation to support the credit claim in case of an audit. That’s where Bottomline Savings, a trusted financial consulting firm, comes into play. We’ll explore later on why they are ideally suited to help your business claim the Employee Retention Credit.

Interaction with other Relief Measures

The Employee Retention Credit (ERC) can be utilized in conjunction with other relief measures, such as the Paycheck Protection Program (PPP), but certain limitations apply. Employers should carefully evaluate the interactions between various programs to maximize their benefits and avoid any compliance issues.

Key Benefits of the Employee Retention Credit (ERC)

Implementing the Employee Retention Credit presents several significant benefits for eligible employers:

- Cost Savings: The credit offers substantial bottomline savings by reducing the overall tax liability, helping businesses retain valuable capital for other essential expenses.

- Employee Retention: By providing financial support, the credit encourages businesses to retain their workforce, fostering stability, loyalty, and productivity.

- Flexibility: The credit is designed to accommodate businesses of various sizes and sectors, allowing a wide range of organizations to benefit from this initiative.

- Cash Flow Enhancement: Employers can choose to claim the credit against payroll taxes or request advance payments, providing immediate financial relief during challenging times.

Industries Impacted by the Employee Retention Credit

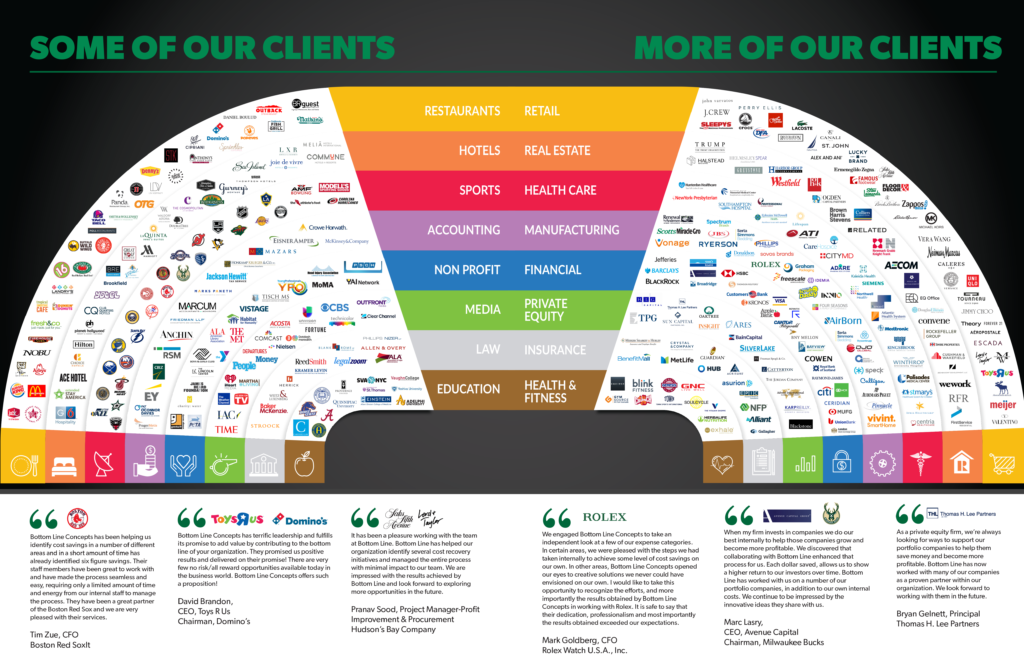

The Employee Retention Credit has had a profound impact on various industries, providing them with much-needed support during these challenging times. Let’s explore in more detail how different sectors have leveraged this credit to their advantage and how it has aided in their recovery and sustainability.

- Hospitality Industry: The hospitality sector, encompassing hotels, restaurants, and entertainment venues, has been one of the hardest hit by the pandemic. With travel restrictions, lockdowns, and reduced consumer spending, businesses in this industry faced significant revenue losses. The Employee Retention Credit has played a vital role in helping these establishments retain their skilled workforce, providing financial relief and stability during a time when their operations were severely impacted. By utilizing the credit, hospitality businesses were able to preserve their staff, adapt to changing customer demands, and position themselves for a strong recovery as travel and dining restrictions eased.

- Retail Sector: Retailers faced unique challenges during the pandemic, with physical store closures, reduced foot traffic, and shifting consumer behavior. The Employee Retention Credit became a lifeline for many retail businesses, allowing them to retain their employees and invest in strategies to pivot their operations. Whether it was expanding their online presence, enhancing e-commerce capabilities, or implementing new safety measures, the credit empowered retailers to adapt to the evolving market and maintain their workforce, ensuring continued service to their customers.

- Manufacturing and Construction: The manufacturing and construction industries experienced disruptions due to supply chain disruptions, project delays, and decreased demand. The Employee Retention Credit has been instrumental in supporting these sectors by enabling employers to keep their skilled workforce intact, ensuring business continuity and minimizing the impact of economic uncertainty. By retaining their employees, manufacturing and construction companies were better positioned to resume operations efficiently when conditions improved, contributing to the overall economic recovery.

- Healthcare Sector: The healthcare industry faced unprecedented challenges during the pandemic, with increased demands for services, overwhelmed healthcare facilities, and the need to ensure the safety and well-being of medical personnel. The Employee Retention Credit has been a valuable resource for healthcare organizations, providing financial relief and stability to retain their healthcare professionals and support staff. By leveraging the credit, healthcare providers could continue delivering essential care, implementing necessary safety protocols, and addressing the evolving needs of their patients.

- Professional Services: Professional service firms, including accounting, legal, and consulting firms, also felt the impact of the pandemic. As businesses faced economic uncertainty and financial constraints, demand for professional services fluctuated. The Employee Retention Credit supported these firms by offering financial relief, allowing them to retain their skilled workforce and continue providing essential services to their clients. By preserving their talent pool, professional service firms remained well-positioned to assist businesses in navigating complex regulations, providing crucial guidance during challenging times.

- Non-profit Organizations: Non-profit organizations, including charitable foundations, educational institutions, and social service providers, encountered unique challenges as they faced increased demand for their services while grappling with fundraising difficulties. The Employee Retention Credit proved to be a valuable tool for non-profits, offering financial support to retain their dedicated employees and sustain their operations. By leveraging the credit, these organizations were able to continue delivering critical programs, supporting communities, and fulfilling their missions, even in the face of unprecedented obstacles.

- Technology Companies: Technology companies experienced a mix of opportunities and challenges during the pandemic, with some sectors witnessing increased demand while others faced setbacks. The Employee Retention Credit played a crucial role in supporting tech companies by allowing them to retain their skilled workforce, invest in innovation, and adapt to changing market dynamics. By preserving their talent pool, technology companies were able to seize emerging opportunities, contribute to digital transformation, and drive economic growth in the post-pandemic landscape.

It’s important to note that the above examples represent just a glimpse of the industries that have benefited from the Employee Retention Credit (ERC). Numerous other sectors, such as transportation, logistics, education, and more, have also leveraged the credit to navigate these challenging times and emerge stronger.

Expert Guidance and Compliance

Navigating the intricacies of tax laws and ensuring compliance with the Employee Retention Credit can be a complex task. To make the most of this opportunity while avoiding compliance issues, it is highly recommended to seek expert guidance from experienced tax professionals.

Tax experts specializing in employment tax credits can provide invaluable support throughout the process. They can assist with eligibility assessments, guide businesses in accurately calculating the credit, and ensure the maintenance of necessary documentation to support their claims. These professionals stay abreast of the latest regulations and can provide insights on optimizing the benefits of the Employee Retention Credit while maintaining compliance with all applicable laws and regulations.

That’s where Bottomline Savings, a trusted financial consulting firm, comes into play. We’ll explore why Bottomline Savings is ideally suited to help small businesses unlock the full potential of the Employee Retention Credit and achieve significant bottomline savings.

- Expertise in Employment Tax Credits:

Bottomline Savings specializes in employment tax credits and has extensive experience in navigating the complexities of the Employee Retention Credit. Their team of skilled professionals stays up to date with the latest regulations, ensuring that they can provide accurate and timely guidance to small businesses. By partnering with Bottomline Savings, small businesses gain access to their in-depth knowledge and expertise, ensuring they can maximize their savings while remaining compliant with all applicable laws and regulations.

- Personalized Approach:

Bottomline Savings understands that each small business has unique circumstances and challenges. Their personalized approach allows them to tailor their services to meet the specific needs of individual businesses. They take the time to assess a business’s eligibility for the Employee Retention Credit, analyze their financial situation, and provide tailored strategies to optimize their savings. By working closely with small businesses, Bottomline Savings ensures that they receive customized solutions that align with their goals and objectives. Click here for a free consultation call to see if you qualify for the Employee Retention Credit (ERC).

- Comprehensive Assessment and Documentation:

Applying for the Employee Retention Credit requires a comprehensive assessment of eligibility and meticulous documentation. Bottomline Savings assists small businesses in evaluating their eligibility for the credit, ensuring that they meet the necessary criteria to qualify. Moreover, they provide guidance on gathering and organizing the required documentation, streamlining the process and minimizing the risk of errors or omissions. This comprehensive approach reduces the administrative burden on small businesses, allowing them to focus on their core operations while Bottomline Savings handles the intricate details.

- Maximizing Savings Potential:

Bottomline Savings goes above and beyond to help small businesses maximize their savings potential through the Employee Retention Credit. They conduct thorough analyses to identify all eligible wages and factors that can contribute to maximizing the credit amount. By leveraging their expertise, they can identify opportunities that businesses may have overlooked, resulting in significant bottomline savings. Their attention to detail and commitment to achieving the best possible outcomes make them an invaluable partner for small businesses aiming to optimize their savings.

Conclusion

The Employee Retention Credit has emerged as a critical lifeline, offering substantial savings to businesses across industries while reinforcing their efforts in retaining employees and ensuring sustainability. By unlocking financial relief, this government initiative has played a pivotal role in stabilizing businesses, preserving jobs, and driving economic recovery.

As organizations continue to adapt and navigate the evolving landscape, staying informed about the latest eligibility criteria, credit calculations, and compliance requirements associated with the Employee Retention Credit is paramount. Seeking expert guidance from experienced tax professionals such as Bottomline Savings can provide businesses with the knowledge and support necessary to make informed decisions, optimize their benefits, and remain compliant with all applicable regulations. Click here for a free consultation call to find out if your business qualifies.

In conclusion, the Employee Retention Credit (ERC) has proven to be a powerful tool in helping businesses overcome the challenges posed by the COVID-19 pandemic. By leveraging this credit, businesses have been able to safeguard their workforce, weather economic uncertainties, and position themselves for long-term success. As we look ahead to a brighter future, it is crucial for organizations to stay informed, adapt their strategies, and harness the full potential of the Employee Retention Credit to drive growth, innovation, and resilience in the post-pandemic world.

One Comment